| |

Investment Philosophy

|

We invest in businesses that we can 'understand'

'Understanding a business' implies that we should be able to figure out how the business makes money, why a customer pays for its products / services today & why the same customer will keep paying for it tomorrow.

Though many businesses fall within our circle of competence, there are a few which fall outside (e.g. biotech, high-technology driven, etc), where we will hesitate to put money. |

|

|

| |

|

| |

| |

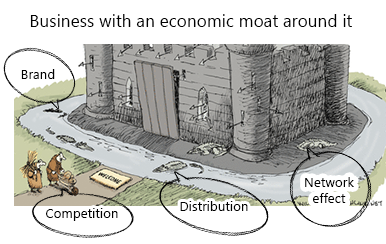

Prefer businesses with an economic moat

Related to the first point, business needs to have a sustainable competitive advantage.

This advantage may stem from brand-name, distribution network, capital costs, location, etc.

Idea is to identify companies which can keep competition at bay & enjoy pricing power.

We also try to identify risks associated in such businesses (cyclicality, scalability, customer concentration, management dependency, regulatory, etc). |

|

|

| |

|

| |

Business should be run by able managers

Here we try to understand the 'capital allocation' strategy of the business manager. We spend time understanding the history of such decisions & their results by looking at the reported financials for last 10-15 years.

Emphasis is given on company's accounting policies, managerial remuneration, treatment of minority shareholders & ROCE / ROE metrics.

However idea is to bet on the 'horse' (business) & not on the 'jockey' (management). |

|

|

| |

|

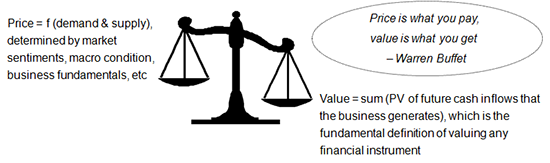

Will not pay a high price for acquiring the business

Future cash flows are ascertained & used in a DCF model (with conservative assumptions) to arrive at the intrinsic value of the business. Other various valuation metrics like free cash flow yield, historical PE, PB, EV/EBITDA trading bands, etc are also used. This value is compared to the price (quoted in the market) to gauge the valuation attractiveness. Please also note that this value is not static & keeps changing as the business evolves with the passage of time.

Typically invest if value is significantly higher than the price (this margin of safety helps in absorbing risks & any mistakes committed in understanding / evaluating the business).

|

| |

Analogy to the game of Cricket

|

Investment can also be compared with Cricket wherein the investor is the batsman & market is the bowler who is throwing different stocks at different prices towards the investor. Unlike a typical player in the market who has a view on most of the stocks & tries to make money on market movements (in effect swinging his bat at most of the balls & risking his wicket), we play the game with our own set of rules.

We will swing only when the ball is a loose ball where we are more certain to reach a boundary. At rest of the times we enjoy standing with the bat & let the ball pass. Fortunately unlike Cricket, there is no limit on the number of balls faced. We would believe that more than the skill needed in swinging the bat, this game is of patience & discipline and requires a right temperament. |

| |

| |

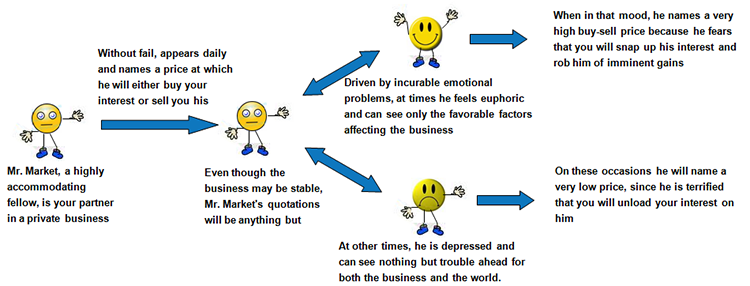

Benjamin Graham's allegory : Mr. Market

|

Benjamin Graham (father of Value Investing & teacher / professor of Warren Buffet) has beautifully captured the role of 'stock markets' through his story of Mr. Market.

Graham asks the reader to imagine that he is one of the two owners of a business, along with a partner called Mr. Market. The partner frequently offers to sell his share of the business or to buy the reader's share. This partner is what today would be called manic-depressive, with his estimate of the business's value going from very pessimistic to wildly optimistic. The reader is always free to decline the partner's offer, since he will soon come back with an entirely different offer.

Mr. Market has another endearing characteristic. He doesn't mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at our option. If he shows up some day in a particularly foolish mood, we are free to either ignore him or to take advantage of him, but it will be disastrous if we fall under his influence. |

| |

|